Monday, June 01, 2009

Superferry bankruptcy pre-determined?

by Larry Geller

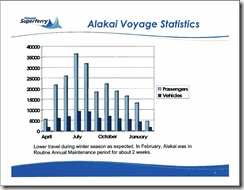

(Click for larger)

This chart is from the one quarterly report that the governor prepared to submit to the legislature (the Jan-March 2009 quarterly report).

The report helpfully includes the caption “Lower travel during the winter months is expected.” If it is expected, and looking at the chart, then bean counters would have to conclude that the question about bankruptcy was not “if” but most likely “when.” At least, they would have had to have plans for how and when to pull the plug.

This isn’t a case of 20-20 hindsight. If you’ve been reading the Hawaii blogs, you know that external estimates, which admittedly can never be certain, indicated that the Superferry company most likely was continually hemorrhaging money. The popular theory, which again is speculation, was that HSF was being used to prove seaworthiness of the vessel design so that Austal USA could get lucrative military contracts.

A lot of speculation, you may say, but on the other hand, it is usually hard to justify continuing a business that cannot make money. If they intended to make a go of it in Hawaii as a passenger ferry, it doesn’t appear to have worked well enough, and if they were proving seaworthiness, well, mission accomplished.

Let’s take a closer look at the numbers, based on information from HSF itself, and a back-of-the envelope estimate by our citizen analysts.

During the course of the Supreme Court trial, and earlier as well, HSF is reported to have stated that its costs were $650,000 per week when not operating. So that would be $2,600,000 lost per month. Note that if the ferry is not operating, it uses little fuel and other expenses are also minimal, but if it runs, it has to pay for fuel. So when operating, by their own statement, costs must be above $2,600,000 but we can’t say how much yet.

From the chart, the Superferry had only one good month, July 2008. The current citizen analysis is that 37,000 passengers at an approximate $55 fare is $2,035,000. For vehicles, 9,000 vehicles at an approximate $60 fare each would be $540,000. This gives an approximate income of $2,575,000. Remember, we don’t know fuel, labor, or other costs.

So even in its best month, HSF likely lost money, it’s only a question of how much.

And it’s been downhill ever since.

Plus, check the unpaid bills in the bankruptcy filing.

In a business actually intending to earn money, the officers would have had to be scratching their heads for some time wondering about whether their business plan was sound, and contemplating quitting or going bankrupt to shed its obligations if not. Similarly, if theories about HSF’s possible role as a test bed for further military contracts hold any water, there would have been a plan as to when and how to wrap up services in Hawaii.

We don’t know what was on their minds and it doesn’t much matter. The business appears not to be capable of making money, nor did they try and modify it so that it might (for example, by applying for a freight tariff so they could take on cargo).

Press accounts of how the end came correctly report that services stopped due to the Supreme Court ruling. Had they dug deeper, they might also have reported that the Court simply put an end to a business that was losing, rather than making, money.

Throughout the Superferry’s history in the Islands, the press has avoided digging into its performance. If it had done so, the public would have better understood the economic and perhaps also the political dynamics of this long-running disaster.

We also could have understood what it would take to put a viable interisland ferry service in place, if that is possible. That is the longer term loss from this experience.

Well said Larry.

One little calc in there is a little off, but the conclusions are accurate.

The one winner in this appears to be Austal if not also some of the other preferred stockholders. Austal's Chairman told the Western Australian press today that they think they will get control of the two vessels out of this. If that happens, I'd say they are the win-win winners in this **for the time being.** They got the contracts, proved the construction capability with A615 and A616, and they think they will get the vessels too. See article:

"Austal customer bankrupt, owes $26.3m" * June 2, 2009

"Shipbuilder Austal Ltd does not expect to find itself out of pocket after one of its customers filed for Chapter 11 bankruptcy in the United States.

Ferry charter operator Hawaii Superferry has filed for bankruptcy in the US Court of Delaware, owing Austal $US21.3 million ($A26.3 million).

The loan was provided by Austal as part of a deal to sell Hawaii Superferry two high-speed vessels.

Austal said in a statement on Tuesday that ***Hawaii Superferry would attempt to reorganise its affairs to allow it to continue as a going concern.***

"If the business continues to operate, the chances of Austal getting its money back eventually are high," Austal executive chairman John Rothwell told AAP.

***Mr Rothwell said it was likely that ownership of the vessels would return to Austal, which would then charter them to the US Department of Defence.***

Austal holds a second registered mortgage over the vessels, ranking it as a creditor behind the US Maritime Administration..."

So the Aussies think these two vessels would be most useful to the US DoD. This reminds me of the fast cat designs that another Aussie firm sold to the Chinese which were reengineered into fast attack class vessels. I'd say the Aussies so far have played all sides on this pretty well, the Chinese, Americans, Hawaii, Alabama, DoD, and JFL. What remains to be seen is how well aluminium performs under fire. I'm guessing it will eventually fail if the Falklands War offered any lessons. In the meantime halfwitted decendents of prisoners will have hoodwinked both the Chinese and Americans to spend money on things they don't need.

<< Home

Post a Comment

Requiring those Captcha codes at least temporarily, in the hopes that it quells the flood of comment spam I've been receiving.