Wednesday, December 31, 2008

Will the economy recover in 2009, 2010, ??? Read about an earlier bubble

by Larry Geller

Let’s play economist. Unlike do-it-yourself surgery or even woodwork, this is perfectly safe for anyone to try. I have discovered a sharp tool for you (I always believed I could build almost anything given decent tools. Maybe it’s a guy thing…).

The static image below will link you to a download page for an interactive demo of a model put together in Mathematica, an extremely versatile and useful program. I’ll get back to Mathematica at the end of the article.

So here’s a model that you can not only look at, but you can download and use it interactively. If you want to go beyond this, you’ll need to buy the program that created it.

The full graph doesn’t fit on this page, click on it to go the article and see the full image. That’s also the page where you can download your own interactive model.

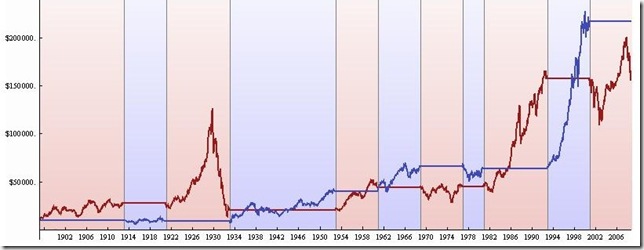

The purpose of this modeling is to investigate a claim in the New York Times (See the article on the Wolfram Blog here):

The New York Times recently published an “Op-Chart” by Tommy McCall on its Opinion page showing what your returns would have been had you started with $10,000 in 1929 and invested it in the stock market, but only during the administrations of either Democratic or Republican presidents. His calculations showed that if you had invested only during Republican administrations you would now have $11,733 while if you had invested only during Democratic administrations you would now have $300,671. Twenty-five times as much!

That’s a worthwhile subject. Aside from demonstrating the usefulness of the Mathematica package, Thomas Gray, the author of the article and of the model, has used it to reveal some interesting and important truths. Here’s the one that caught my eye:

It gets really interesting if you extend the timeline back and make your initial investment in 1897. Now we see that the crash of 1929 was really the bursting of a bubble: the 12 Republican years of Harding, Coolidge, and Hoover were a wild ride, but more or less a wash in the end. (The Dow’s peak in 1929 would not be seen again until 1954! Imagine, 25 years including the worst depression and the greatest war the world has ever seen, and in all that time the stock market never reached the level it had for a few giddy months in 1929. Will it be 25 years before we match the Dow’s high of 2008?)

History may or may not repeat itself. I think the earlier bubble and this one we’ve just seen burst might have some parallels, and of course, many differences. But the question remains whether the people who brought us the current crisis, and who are still in charge, can bring us out of it (note that they’ll keep their buddies whole regardless of what happens to us). I’m not sure they even care what happens to us.

Let me add that we cannot let economists bamboozle us by having us adopt measures of economic health that are relevant mainly to the very rich. The average hotel worker or unemployed airline pilot would not check the stock market for signs that they will be better or worse off in the coming year. The media perpetuate these measures and the myth that what is good for the stock market is good for us. It isn’t. There’s little relationship (unless you have a 401(k) plan). Readers of alternative media know that effective wages have been on the decline for decades even as expenses have steadily increased.

In fact, the stock position of a company has become a tool to beat down labor. Management is interested only in keeping that stock price high and ever-increasing. We are bamboozled indeed if we let them get away with that argument.

Anyway, if you visit the Mathematica web page linked above you’ll not only have a chance to download and play with the sample model, but be introduced to this package, which is a very sharp tool indeed.

I’ve been a champion of mathematical modeling since my college years. Even way back then, I earned my college tuition and more simply by working for a Merrill Lynch researcher for a few hours each Saturday. I knew how to run the GE timesharing computer, he knew how to create useful models of the economy affecting their business. I had no idea what he was doing. It was something like being an alchemist’s apprentice, stirring the pot when ordered, but not knowing what it was all about.

Many things can be usefully modeled, by the way. I’m convinced that Hawaii’s economy could be modeled, and perhaps the exercise would yield useful insights and guidance. Even a power grid can be modeled.

Modeling is more than numbers. I was first attracted to the Mathematica web pages by its capability to manipulate and present visual information.

This particular page, posted at the beginning of this month, has an attractive and playful presentation of its graphics capabilities. But go there and click on the video of the geese flying. That’s worth the whole visit in itself. Then look how easily the image can be manipulated. Impressive. Fun. Take a look.

It will take your mind off the stock market for a few moments, too.

Have a Happy New Year everyone, and please come back for more Disappeared News next year.

If we are unwinding a depressive bubble, this thing could last 10 to 15 years, worst case. The economy WILL get worse in 2009. Best case senerio, things stabilize in 2010 and improve slightly in 2011, but personally I don't think so. I believe we are in for a series of crisises one after another that last for years, maybe a decade, and that governments, society, and countries including our own will change dramatically in the coming decade.

<< Home

Post a Comment

Requiring those Captcha codes at least temporarily, in the hopes that it quells the flood of comment spam I've been receiving.